Salesforce's Crazy CDP Pricing

It's not news that Salesforce remains in transition regarding its Customer Data Platform (CDP) offerings. After acquiring longtime CDP vendor Evergage, Salesforce has rebranded it and replaced a formerly separate offering as "Interaction Studio," largely for personalization and journey listening. In certain circumstances Salesforce will still sometimes pitch Evergage into CDP engagements, but more recently has touted its homegrown "Customer 360 Audiences" platform.

Subscribers to RSG's CDP vendor evaluation research know that Audiences remains very much a work-in-progress, with many of its core services substantially lagging competing offerings. Crucially, Audiences relies on many other Salesforce platforms for a complete solution. This speaks to the platform's youth, but also Salesforce's broader strategy of wanting to lock you into a broad suite of cobbled-together platforms. In this respect, Salesforce is mimicking other big MarTech players, including Acoustic (ex-IBM), Adobe, Microsoft, and Oracle.

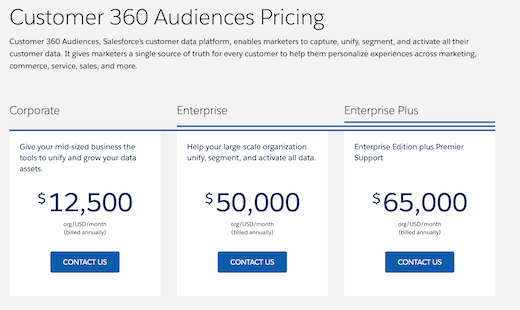

Now, you might reasonably think that under the circumstances, Salesforce would price Audiences more aggressively, but you'd be wrong. Audiences CDP is actually quite pricey; in fact for a larger enterprise, ungodly expensive.

At $12.5k/month, the entry-level price falls in the lower quartile of what we'd typically see as annual CDP licensing. But note that it only supports a dataset of 45K records...definitely on the lower end of what you'd see even in a B2B environment.

The $50-65k/mo editions put you at the very top of the CDP pricing range, where competitors at this price point are likely to offer super-sophisticated data processing, eventing, and activation for tens of millions (or more) of records. With Salesforce you receive healthy data transfer volumes, but still limited at this price to 500k records, and still a feature-poor platform. Over the past year I've had at least some visibility into nearly two-dozen enterprise CDP procurements, and only one of them had a database of less than 500k individuals.

To be fair, Salesforce should be commended for publishing its pricing openly when, for example an ever-opaque Adobe would never do so. And you might obtain some multi-platform discounts upon licensing other (often essential) adjacent and lower-level Salesforce platforms. Yet the sheer mis-match between list price and what you actually get with this CDP could also confirm my suspicion that Salesforce — like some of its peers — is not trying to win CDP deals on value, but on pre-existing relationships.

Relationships matter, but should never get over-weighted in any MarTech selection process. Always perform careful technical and usability diligence, including hands-on testing against people-oriented narrative test cases.

If you'd like to see a sample of how RSG evaluates CDP vendors, you can always obtain a complimentary excerpt.

Hat-tip to my colleague Apoorv, who first pointed me to this pricing.