Salesforce and the Real Story on CRM Marketshare

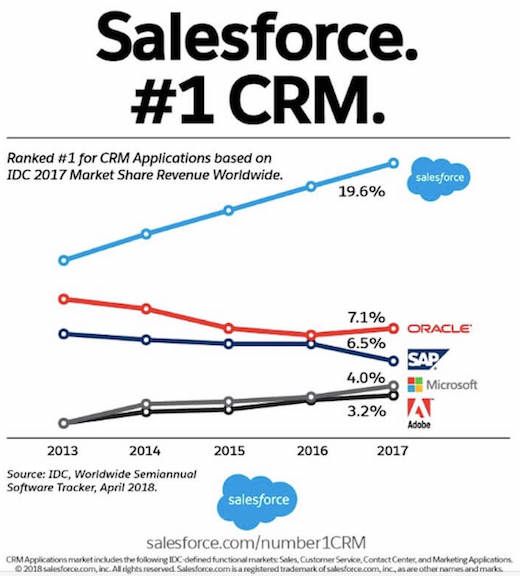

Salesforce likes to tout its marketshare lead in the CRM space, and peppers its advertising messages with the graphic below. However, this data tells us more about the broader customer experience landscape than about Salesforce itself.

Source: Salesforce.com, based on IDC data

The underlying data comes from IDC, which is a reasonably reputable source, but remember that all marketshare data is suspect, especially if the markets are fragmented, fungible, and characterized by a plethora of privately-held vendors (more about that below).

More importantly, the fine print notes that the data also includes non-CRM technology, such as marketing platforms — that's why Adobe's on the chart, even though they don't sell a real CRM. The chart should then include IBM, which offers a sizable slate of marketing technologies, and it will tend to under-weight SAP and Microsoft, who do not. So, the graphic is misleading. Surprise, surprise!

The CRM Market

Even if we presume this data relates primarily to CRM, the next most interesting take-away is that among these major vendors, they only make up 40% of the market. That's intriguing, because, compared to other MarTech segments, the CRM market has relatively few global players. RSG evaluates eight major CRM vendors head-to-head. But a lot of CRM-type services get delivered via more generic business management suites, especially for small to mid-sized enterprises.

Major CRM vendors in two categories. Source: Real Story Group

CRM Market Trends

It's possible that Salesforce is expanding its (relatively modest) marketshare, but there are other trends in the industry worth watching:

- Microsoft remains a stubbornly strong contender, even though Redmond seems loathe to invest in other MarTech solutions

- Customers are struggling with CRM capabilities "baked into" other business platforms, but are unlikely to select a complex and expensive toolset from a major tech vendor, so we can expect simpler CRM solutions to proliferate below the radar

- B2C and increasingly B2B enterprise customers are starting separate their customer data stores from their sales and support delivery silos; this is reducing the scope of CRM

That last trend is just starting, and will impact many technologies, but particularly CRM. If you're thinking about licensing Customer Data Platform technology, check out RSG's hard-hitting evaluations of the key players in the CDP market.

![[Webinar] The Right Way to Select Technology for Your New Omnichannel Stack](/sites/default/files/styles/blog_thumbnail/public/blog/Omnichannel%20Stack%20Selection%202020%20small.jpeg?itok=-u84mYo8)