The Myth of Technology Analyst Independence

Coming up on Real Story Group's 20th anniversary next year caused me to reflect: as far as I know we are the only technology analyst firm in the world that works exclusively on the "buy side." That is, we work only for you, the technology customer.

If you had asked me 20 years ago — when the world started reeling from an equities collapse aggravated in part by conflict-of-interest shenanigans on Wall Street — I would have predicted the global technology analyst community would split neatly between sell-side research and buy-side research.

Yet that has not happened, and you the customer are the worse off for it.

The Financial Industry Analyst Model

In financial research, the industry makes a clear distinction between "sell-side" and "buy-side" analysis. A sell-side financial analyst relies on information often spoon-fed from public companies to drive activity to trading desks (i.e., works primarily on behalf of sellers), while a buy-side specialist strives to inform better investor performance (i.e., works primarily on behalf of buyers). The same advisory or investment firm can employ both buy- and sell-side analysts, but they must isolate themselves behind "Chinese Firewalls," designed to prevent buy- and sell-side specialists from even talking to each other without a lawyer present.

That firewall gets breached with some regularity. Former top Salomon Smith Barney research analyst Jack Grubman famously declared in 2000 that, "What used to be a conflict is now a synergy," and, "Objectivity? The other word for it is uninformed." The US Security and Exchanges Commission declared otherwise and banned him in perpetuity from financial services for gross ethical misconduct.

The Technology Industry Analyst Model

A technology analyst community that fails to distinguish between buy- and sell-side is essentially channeling Jack Grubman. In the tech analyst community, the incentive to advise both buyers and suppliers is not perceived as a conflict, but a synergy. Analyst firms get rated by potential vendor sponsors according to how much influence they have over buyers.

Analysts walking both sides of the street can feel like gods. "I'm sculpting the industry," bragged Grubman, "I get feedback from [buyer] institutions and [seller] CEOs. It feeds on itself. It's a virtuous circle." Except the SEC concluded it was a vicious circle for investors. Technology analyst firms similarly tout their ability to advise customers based on insider knowledge of vendor plans -- plans the analyst firm often devised on the vendor's behalf for a lucrative consulting fee.

Vendors Have to Play the Game

This system creates dilemmas for tech suppliers. Either they play what can become a very dirty analyst relations game, or get ignored at their peril. Check out this candid advice that an analyst relations professional gives to his vendor clients: Become a paid subscriber if you want the analyst firm to take your calls regularly — or even just remember your name.

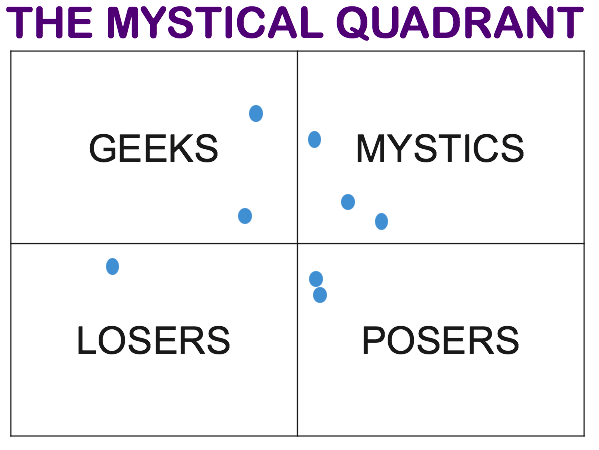

Vendors typically can’t buy their way into ratings charts, but as a client of that analyst firm they obtain crucial access to lobby for better placement....and hence mystical results.

Yet there's an even deeper game here. The Forresters and Gartners of this world avidly consult on vendor strategy and tactics; this "sell-side" advisory can represent half or more of an analyst firm's revenue. If the analyst firm advised a vendor on their roadmap and execution, will that same firm ever dare to criticize the vendor who acted on those plans? In the analyst industry this scenario sometimes gets laughed off as "calling your own children ugly," and unsurprisingly, it doesn't happen often.

Individuals at major tech analyst firms consistently protest that they try to follow a rigorous personal ethical code. I believe them. But the system is corrupt. Those Magic Quadrants you download for free? The reprint rights are purchased by vendors who reside in the upper right.

Vendor as Lobbyist

One of the conceits of the vendor "analyst relations" professions is that it's just like public relations: A firm invests to get attention. There's actually a big difference. In countries with a free press, reporters don't get paid to take weekly briefings with the newspaper's largest advertisers. So, analyst relations is less like PR and more like government lobbying—and just as greasy. Vendors pay analyst firms for access, and it's all dark money.

Vendors grease the palms of analyst firms year after year only because those fees bring a return on investment, in terms of greater visibility and presumably higher sales. But then by definition, this warps the market, and you pay the price.

The Impact on You the Customer

Let's review how these conflicts skew analyst firm vendor evaluations.

- Major analyst firms tend to pay more attention to the vendors that also have business relationships with them. This means that technology evaluations tend to favor larger vendors over smaller vendors, and commercial players over open source.

- Major analyst firms almost universally overweight vendors' marketing acumen and powerpoints — decks that the analyst may have helped to create in the first place (!), and in any case have little bearing on customer success. Traditional quadrants underweight things like vendor technical support, scalability, and technical debt....all huge issues for you. As a result, you get a distorted view of vendor competencies and fit.

- Major analyst firms consistently lag the market in identifying declining products if those offerings come from important vendor customers (e.g., the particularly ugly demise of the former Autonomy/Interwoven toolset). This is happening right now with analyst reviews of major offerings from Adobe, Oracle, Salesforce, Sitecore and others. Easily my saddest experiences as an analyst is to consistently witness very creative digital professionals struggling under the weight of a ill-fitting platform from a "name" vendor. Caveat lector.

RSG's research is far from perfect. We deliberately emphasize implementation lessons and vendor/product ecosystems, and that will bias our results. But this bias stems from wanting to serve a particular enterprise buyer profile, and not from the need to generate vendor advisory business or "sculpt an industry."

What Is to Be Done?

Alas, there is no SEC-like body to oversee the technology analyst industry. You can understand the absence....we're not that important. But as enterprises turn ever-greater attention and budgets to digital transformation, the stakes have gotten higher and the conflicts of interest become all that more heightened.

Change will come when customers demand it. As a customer you should insist on greater transparency rather than platitudes. Vendors are clear about where they need to spend analyst relations budgets, but as a customer you have many choices about where you get technology advice.

When you pay an analyst firm for research and advisory, you should insist on two things:

- That the firm focuses on sell- or buy-side exclusively (not both) or implements Chinese Firewalls to separate buy and sell sides with the same rigor as their financial analyst firm brethren.

- That their published research is designed to serve your particular enterprise buyer profile and not issued to generate vendor advisory business or "sculpt an industry."

In the meantime, let's call the mainstream technology analyst industry what it truly is: a highly conflicted buy/sell-side operation masquerading under the guise of independence.

Here's some info on a different approach to evaluating technology. Have any thoughts on this? Join the conversation on LinkedIn.