Has Covid Infected MarTech Vendor Pricing?

By now we all know that Covid has impacted MarTech stack decision-making. Among other things, it has affected enterprise thinking around Customer Data Platform (CDP) technology. Yet there's one other phenomenon we've seen at RSG: the pandemic is also disrupting MarTech vendor pricing bids.

Specifically, we're seeing vendor proposals with fee scales all over the map. To be sure, technology platform pricing has always been a crap shoot, though usually that's because enterprises will include vastly different tiers of players in their competitions. Now it seems — like everything else — the pandemic has become an accelerant to vendor pricing strategies, with some bidding very low to emphasize new customer acquisition, while others push for higher margins by exploiting your desire to shift quickly.

As always, you'll want to consider your own orientation here. Is your enterprise truly desperate to accelerate customer-driven digital transformation? Or are you taking a more measured approach? Maybe the answer is "a little of both," but in any case, I'll always recommend that you steward your MarTech budgets carefully.

Some Examples

Here are some examples we've seen this past quarter, advising RSG research subscribers on major selection projects.

DAM

In one Digital Asset Management competition, we saw annual fees ranging from $70-260k for a fairly detailed set of requirements. To be fair, the high one was an outlier, albeit not a high-end vendor. As this marketplace has matured, it's settling into clear tiers, and RSG's DAM vendor evaluation research suggests you often find high value in the mid-market.

Note that these enterprises were not tossing vague requirements against the wall. They followed RSG's highly structured, multi-step evaluation methodology, which is designed to yield very specific responses. Some vendors are just guessing what the market will bear — and I guess enough enterprise customers are falling for it.

CDP

The Customer Data Platform marketplace was already complicated before the pandemic hit: on the one hand over-hyped, on the other, it features a multitude of competitors. Different architectures and varying scope bring different cost structures, but in general most vendors run flush with venture cash. So, CDP pricing....always a bit hit-and-miss.

But even more so now. In numerous selection projects we've seen 3x difference ($250-750k/year) for comparable capabilities. The good news is that most CDP vendors are still rushing to lock in customers, so it's a great time to negotiate.

WCM

Even before the pandemic, many Web Content Management vendors were trying to recast themselves as customer experience (CX) platforms. During the crisis those vendors seem eager for more business, but the rationale has gotten thinner. Yes, your website is getting more traffic, but other channels typically see even larger surges. Yes your brand image becomes as important as ever, but exhausted customers want more authentic and instrumental application experiences (likely not delivered by your WCM). In short, the scope of WCM is getting narrower.

Here again in recent procurements we've seen a fair amount of finger-to-the-wind pricing. Like others, the WCM market is highly competitive. Don't accept bids at face value and dig into the real cost levers for any supplier to work out a fair deal.

Some Caveats

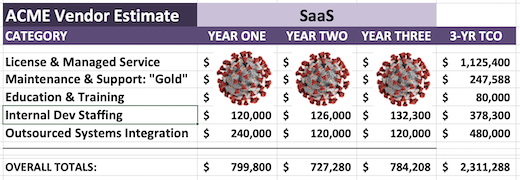

Of course annual technology and hosting fees do not represent your total cost of ownership, and may indeed comprise a fraction. That's all the more reason to keep your powder dry by negotiating a good deal. Investing less in technology ideally frees you up to invest more in people.

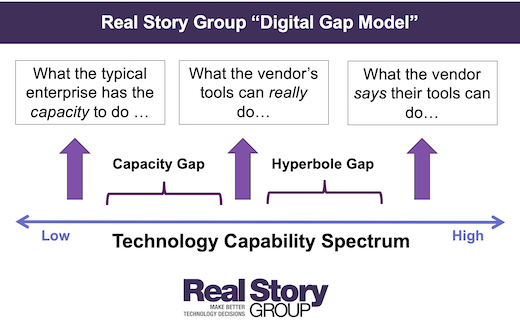

Enterprise digital leaders face two key gaps as they transform marketing: vendor hyperbole and internal capacity. RSG can help you expose vendor hyperbole and find the right-fit solutions. Closing the capacity gap requires solid investment in people and organizational structures. Put the lion's share of your resources there.

This means negotiating your corner. The pandemic presents an opportunity for MarTech vendors in particular, but they must also face the same macro-economic headwinds that affect everyone now. So the same pressure that's compelling you to justify MarTech budgets should compel vendors to sharpen pencils going forward.